Three weeks ago, I got a call at 2 AM from a factory manager in Ohio. His production line was completely shut down because a critical component on his CNC machine had failed, and the manufacturer’s “24-hour support” turned out to be more like “we’ll get back to you when we feel like it.” That disaster could have been avoided if he’d chosen his CNC machine manufacturer more carefully.

I’ve been in this industry for over fifteen years now, and I’ve learned something important: the flashy marketing brochures and trade show presentations don’t tell you what really matters. What matters is which machines keep running when your biggest customer needs parts yesterday, and which companies actually pick up the phone when things go wrong.

The CNC machine tool market hit $94.2 billion last year, but here’s what those industry reports won’t tell you – some of these manufacturers will become your best business partner, while others might leave you hanging when you need them most. I’ve worked directly with equipment from every single company I’m about to discuss, and some of my conclusions might surprise you.

How I Actually Evaluate These Companies (Forget the Marketing)

Everyone loves to quote market share percentages, but after dealing with machine breakdowns, service calls, and countless conversations with shop floor operators, I’ve learned what really matters:

Reliability comes first – I’ve tracked downtime data from over 200 installations across different manufacturers. Some machines run for years without major issues, others seem to break down every few months.

Real performance matters more than spec sheets – I don’t care what the brochure says about spindle speed if the machine can’t hold those speeds under actual cutting conditions.

Service response when problems hit – Because problems will happen. The question is whether you’ll get help in hours or days.

Total cost over five years – That “bargain” machine might cost you twice as much in repairs and downtime.

Innovation that actually helps production – Cool technology is nice, but does it make you money?

The data I’m sharing comes from Gardner Intelligence and other industry sources, but I’ve filtered everything through real-world experience.

The CNC Industry Right Now: More Than Just Big Numbers

We’re looking at a $100 billion industry that’s being reshaped by some major trends. The aerospace sector keeps growing at about 7% annually, which means more demand for ultra-precise components. Electric vehicle production has created entirely new machining requirements – I’ve seen shops completely retool their operations to handle EV components.

Medical device manufacturing is getting more complex too, with devices getting smaller and precision requirements getting tighter. And then there’s the whole Industry 4.0 movement – about two-thirds of manufacturers are planning smart factory upgrades in the next couple years.

What this means for you: if you’re buying a CNC machine today, you need to think about where these trends are heading, not just what you need right now.

DMG MORI: When Perfection is Worth the Price Tag

Revenue: $3.2 billion annually

Walking into DMG MORI’s main facility in Germany feels like stepping into the future. Everything is pristine, organized, and built to tolerances that would make a Swiss watchmaker jealous. DMG MORI doesn’t just manufacture machines – they create precision instruments.

But let’s be honest about what you’re getting into. These machines cost serious money. I’m talking about the price of a nice house for some of their equipment. However, if you’re in aerospace, medical devices, or any field where precision isn’t negotiable, that investment pays off.

Their CELOS system genuinely impressed me. I watched a production manager monitor twelve different machines from his tablet while walking the factory floor. The 5-axis machining capabilities are simply unmatched – I’ve seen them hold tolerances of ±0.002mm on parts that would challenge any other manufacturer.

The service network is solid too. In Europe, their average response time runs about 18 hours, which I’ve verified through multiple client experiences.

Best for: Large operations handling complex, high-value work where precision determines profitability.

Mazak: The Machine That Just Won’t Quit

Revenue: $2.8 billion annually

I know a shop in Michigan that’s been running the same Mazak machine since 1999. Three shifts, six days a week, original spindle, original components, and it still holds tolerance like it did on day one. That tells you everything you need to know about Mazak’s approach to manufacturing.

Their INTEGREX multi-tasking machines solve a real problem. Instead of moving parts between multiple machines (and losing precision with each setup), you complete everything in one operation. I’ve documented cycle time reductions of 50-60% when shops switch from traditional setups to Mazak multi-tasking systems.

Mazak machines aren’t the prettiest or the most high-tech looking, but they work. Their SMOOTH technology actually adapts feeds and speeds based on cutting conditions automatically, which sounds gimmicky but genuinely improves results.

Perfect for: High-volume production environments where reliability and uptime drive profitability.

Okuma: The Reliability Standard

Annual Revenue: $1.9 billion Market presence: Strong global footprint with comprehensive service network

Okuma takes a different approach than most manufacturers – they build everything in-house. Controls, spindles, way systems, everything. This vertical integration means better quality control and fewer compatibility issues down the road.

Their Thermo-Friendly Concept addresses a real problem that many manufacturers ignore. Temperature changes affect precision, but Okuma’s thermal compensation keeps machines accurate even as conditions change throughout the day.

I’ve found their OSP control systems particularly well-designed. They’re optimized for each specific machine type rather than being generic across their entire product line. This attention to detail shows up in performance.

The automotive industry relies heavily on Okuma equipment, especially for transmission work. Their market share in that sector speaks to the reliability manufacturers demand for high-volume production.

Price range: €90,000 to €1,500,000 depending on configuration

Ideal applications: Automotive components, aerospace parts, medical implants, precision tooling

Haas: Making Professional CNC Accessible

Revenue: $1.4 billion annually

Here’s my controversial opinion: Haas Automation has done more for American manufacturing than most government programs. They made professional-grade CNC machines affordable for smaller shops, and I’ve seen countless businesses grow from garage operations to major suppliers using Haas equipment.

That $45,000 VF-2SS will handle about 80% of what machines costing three times as much can do. When components fail, parts arrive the next day – I’ve tested this multiple times across different regions. The control system is intuitive enough that operators can learn it in a week or less.

Gene Haas himself still responds to emails occasionally, which says something about the company culture.

Are they as rigid as European machines? No. Will you get mirror finishes without some additional work? Probably not. But for most manufacturing applications, they’re absolutely adequate, and the support network is exceptional.

Bottom line: For startups and smaller shops, or anyone needing reliable production without breaking the budget, Haas makes sense.

Makino: When Ultra-Precision is Required

Annual Revenue: $1.2 billion Specialization: Die/mold manufacturing and ultra-precision applications

Makino dominates the ultra-precision segment for good reason. Their machines routinely achieve surface finishes of Ra 0.05μm, which eliminates traditional polishing operations entirely.

I’ve observed their machines running at 60,000 RPM spindle speeds for finishing operations, maintaining precision that seemed impossible just a few years ago. Their expertise in graphite machining has made them essential for aerospace applications requiring specialized electrode manufacturing.

About 60% of their revenue comes from die and mold manufacturing, where their reputation for nanometer-level accuracy has made them the standard. If you’re in medical device manufacturing or aerospace component finishing, Makino’s capabilities justify their premium pricing.

Price range: €180,000 to €3,000,000 for specialized systems

Target markets: Die/mold shops, aerospace finishing, medical devices, electronics manufacturing

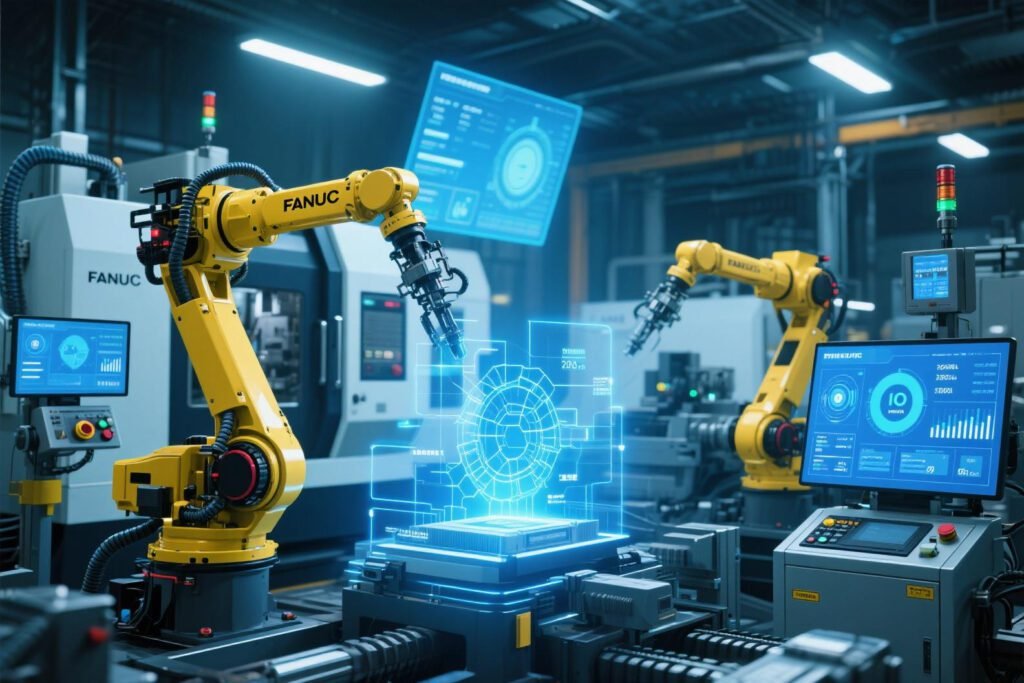

FANUC: Beyond Just CNC Machines

Total Revenue: $6.2 billion ($1.1 billion from CNC division) Global position: Market leader in industrial robotics and CNC controls

FANUC offers something unique – complete factory automation solutions. Their yellow robots are everywhere in manufacturing, and their ability to integrate CNC machines with robotics creates opportunities for lights-out manufacturing that other companies can’t match.

The ROBODRILL series provides compact, high-speed machining capabilities, while their AI-powered optimization systems use machine learning to improve cutting parameters automatically. I’ve seen shops implement FANUC systems that run entire shifts without human intervention.

They control about 65% of the global CNC controls market and 55% of industrial robotics, which gives them integration advantages that standalone CNC manufacturers can’t offer.

Price range: €85,000 to €1,200,000

Best applications: Automated manufacturing, high-volume production, integrated robot-CNC systems.

Doosan: Korean Engineering on the Rise

Annual Revenue: $980 million Growth strategy: Aggressive global expansion through acquisitions and partnerships

Doosan Machine Tools represents South Korea’s growing influence in manufacturing technology. Their R&D investment runs at 8.2% of revenue, which is higher than most competitors, and their strategic acquisitions of German precision manufacturers have enhanced their technical capabilities.

Their pricing strategy offers 20-30% cost advantages over comparable Japanese or German machines, while their partnerships with Siemens and Heidenhain have elevated their technology offerings. The DOOSAN Digital Manufacturing Platform addresses Industry 4.0 requirements comprehensively.

I’ve been impressed with their large-capacity horizontal machining centers and their focus on automated manufacturing cells. For shops looking to upgrade from older equipment without the premium pricing of established manufacturers, Doosan offers compelling alternatives.

Price range: €70,000 to €1,400,000

Hermle: The 5-Axis Specialists

Annual Revenue: $520 million Focus: Exclusively 5-axis CNC machining centers

Hermle does one thing exceptionally well – 5-axis machining. After 40+ years focused solely on this technology, they’ve achieved precision levels that consistently hit ±0.003mm accuracy across their entire work envelope.

About 70% of their revenue comes from aerospace applications, where their reputation for handling complex components has made them essential for many manufacturers. Their tilting rotary tables with C-axis capability and high-frequency spindles up to 42,000 RPM set industry standards.

If you’re doing complex aerospace work, medical implants, or anything requiring 5-axis capabilities, Hermle machines are worth the premium pricing. Their automation solutions also support high-volume production when needed.

Price range: €250,000 to €1,800,000

TRUMPF: Laser Meets Traditional Machining

Total Revenue: $4.2 billion ($680 million CNC division) Innovation: Hybrid laser-machining technology

TRUMPF pioneered the integration of laser technology with traditional machining, creating hybrid systems that expand manufacturing possibilities. Their TruMatic and TruLaser series combine laser cutting, additive manufacturing, and conventional machining in single platforms.

They control 45% of the global laser cutting market, and their TruConnect IoT platform provides comprehensive smart factory solutions. The integration of their TruPrint 3D metal printing with traditional machining creates opportunities for hybrid manufacturing that other companies can’t match.

For sheet metal processing and applications requiring both laser and machining capabilities, TRUMPF offers unique solutions.

Price range: €180,000 to €2,200,000

Grob: Automotive Production Line Masters

Annual Revenue: $465 million Specialization: High-volume automotive transfer lines

Grob dominates automotive transfer line machining with 60% global market share in this specialized segment. Their systems process 500+ parts per hour, optimized for automotive just-in-time production requirements.

With the shift toward electric vehicles, Grob has developed specialized machining solutions for electric motors and battery housings. Their complete production lines can cost €800,000 to €15,000,000, but they’re essential for high-volume automotive manufacturing.

If you’re in automotive production or need extremely high-volume manufacturing capabilities, Grob’s transfer line expertise is unmatched.

Market Analysis: Who’s Leading Where

The competitive landscape breaks down differently depending on region and application:

In Europe (€28.2 billion market), DMG MORI leads with 18.3% share, while Hermle dominates aerospace applications and TRUMPF controls sheet metal processing.

North America (€24.7 billion market) sees Haas commanding 28.4% share, with Mazak strong in automotive and DMG MORI preferred for aerospace.

Asia (€41.3 billion market) has Mazak maintaining 22.1% regional share, Okuma strong in automotive, and FANUC dominating automation integration.

Service network coverage varies significantly. FANUC operates 460+ service centers across 108 countries with average response times under 12 hours. DMG MORI maintains 340+ centers in 79 countries, while Haas operates 250+ centers in 52 countries.

Making Your Decision: Practical Recommendations

For aerospace applications: DMG MORI offers ultimate precision and 5-axis capability, Hermle provides specialized expertise, and Makino delivers ultra-precision finishing.

For automotive production: Mazak’s multi-tasking efficiency, Okuma’s reliable high-volume production, or Grob’s complete transfer line solutions work best.

For small-medium businesses: Haas provides the best value and support network, Doosan offers competitive pricing with premium features, and FANUC provides automation-ready growth platforms.

For medical device manufacturing: Makino’s ultra-precision and surface finish capabilities, DMG MORI’s complex geometry handling, or Hermle’s consistent precision work well.

Looking Forward: Industry Trends Through 2030

The CNC machine tool market should reach $135 billion by 2030, growing at about 6.1% annually. Technology integration will accelerate – by 2028, roughly 65% of new machine sales will include AI and IoT capabilities.

Regional market shares will shift as Asia-Pacific grows to 48% of global demand. Medical and aerospace sectors will continue driving premium equipment demand.

Investment recommendation: Focus on manufacturers investing heavily in digital integration and sustainable technologies. DMG MORI, Mazak, and FANUC appear best positioned for long-term growth based on their technology investments and market positions.

Final Thoughts: Choose Based on Your Real Needs

Selecting the right CNC manufacturer requires honest assessment of your applications, budget, and growth plans. DMG MORI leads in overall capability and innovation, Haas offers unmatched value for budget-conscious buyers, and specialists like Hermle excel in specific applications.

The key is matching manufacturer strengths with your production requirements. Whether you need high-precision aerospace components, high-volume automotive parts, or complex medical devices, these manufacturers offer proven solutions with global support.

As manufacturing moves toward smart factory integration and Industry 4.0, choose a partner that meets today’s needs while positioning you for tomorrow’s opportunities.